Opening a Bank Account in Portugal Online: How We Did It

It seemed so simple…

…but as we have come to learn during this process is that nothing is really as simple as it seems. Just download the app they said. Log in and open an account they said. It’ll be easy they said. Well…yes and no.

In theory, it is a simple process, but that doesn’t mean it was quick and without many steps. Keep reading to find out how our process went.

Keep reading for a step-by-step guide to opening a bank account in Portugal online with ATLANTICO EUROPA.

Renovating Life contains affiliate links. If you make a purchase through these links, we will earn a commission at no extra cost to you. As an Amazon Associate, we earn from qualifying purchases. Links like this allow us to continue providing top-quality content at no cost to you.

Opening a Bank Account in Portugal

Opening a bank account in Portugal while living outside the country is a little tricky. As of now, there are only a few banks in Portugal that allow you to open an account remotely. Some make it possible through a facilitator, financial representative, or lawyer, but we wanted an option that we could complete entirely on our own. So, we chose ATLANTICO because it seemed like the easiest.

By far the easiest way we’ve heard of to open a bank account in Portugal without actually being in the country is using Bordr. They started by helping people get NIFs (Portuguese tax numbers), and have since launched their bank account setup service, introduced packages for NIFs and bank accounts for individuals and couples.. They may soon offer a complete D7 service, so check out their info today if you’re looking for a helping hand along your journey to Portugal.

Click HERE to get 10€ off!

Opening a Bank Account Online with ATLANTICO EUROPA

Download MyAtlantico App

You must complete the application for opening a bank account in Portugal through the mobile app. Unfortunately, this is not possible on a desktop computer.

Tap “Create an Account”

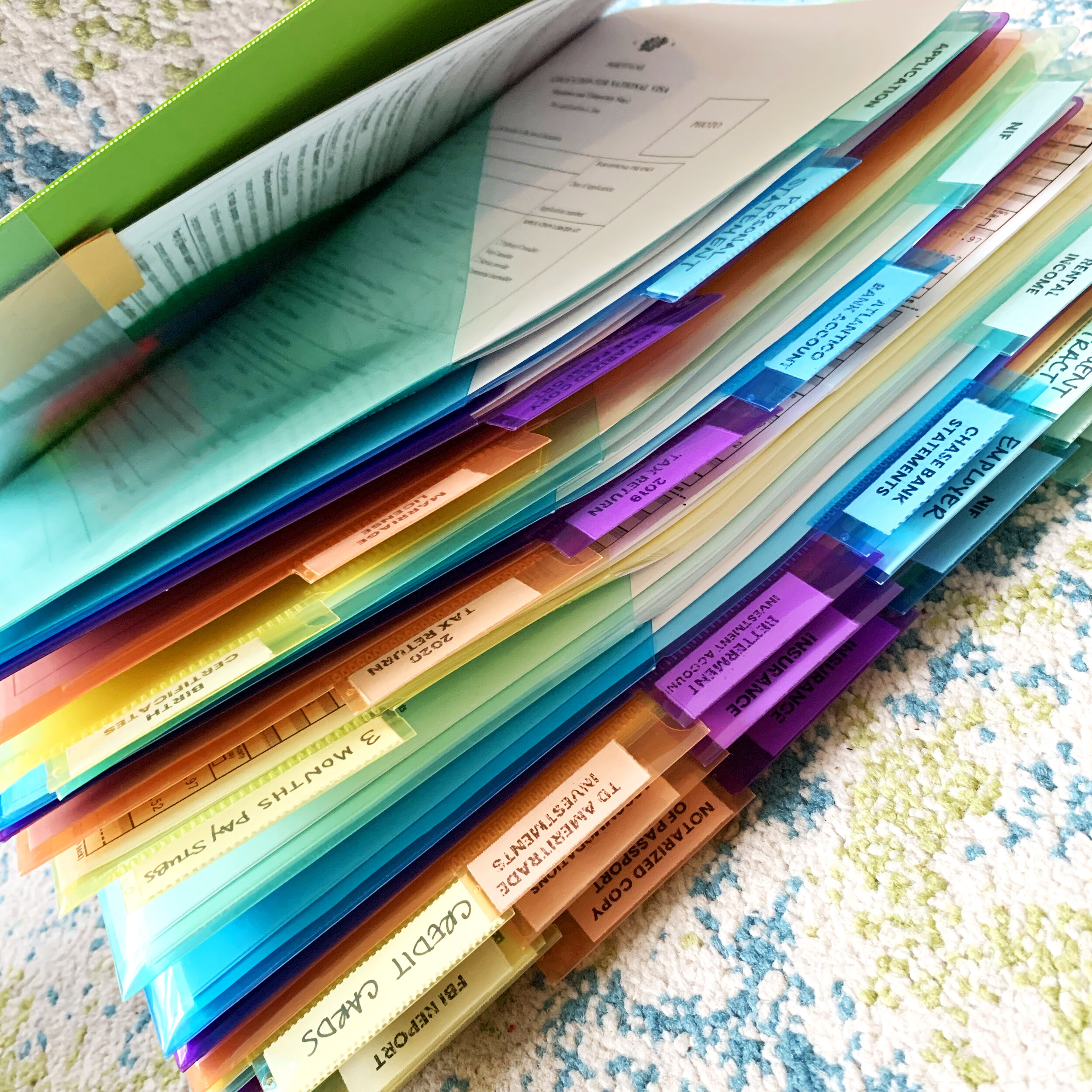

Follow the steps to set up your account. During the account setup, you’ll be required to upload a few documents:

Identity Document

e.g. Portuguese ID Card, Passport or Resident permit, original and valid.

Proof of Address

e.g. valid driving license or current utility bills, not older than 6 months.

Proof of Profession

e.g. payslip, employer entity statement, or last personal income tax return, not older than six months.

After uploading your documents and completing the account setup, you will have the option to add a second “holder” to the account. If you would like to set up a joint account with your partner/spouse, follow this step which takes you through the same process you just completed with the second holder’s information and documents.

Complete Identity Verification

Once you’ve input the information for each holder, you’ll be directed to initiate an identity verification video call through the app. The wait time for someone to accept the call varied every time I called. Sometimes it was 10 minutes, sometimes an hour. Keep in mind you must call during Portugal business hours. The representative will be English speaking and specializes in opening accounts for foreigners.

You’ll need your passport, a blank sheet of white paper, and a blue or black pen.

During the call, the representative will ask to see your passport and will take pictures of you and the signature you produce live while on the call. They’ll ask a few questions such as, “Why are you opening up a bank account in Portugal?” I answered truthfully and simply said we were applying for a residence visa and needed a Portuguese bank account to do so. Then they’ll verify your mobile number and send you a text with a code to enter and that will conclude the call. Make sure you follow the last few screens to complete the process after the call ends.

If you have provided info for a second holder of the account, they will also need to complete their ID verification call. In our case, once I closed my video call and finished the last few screens, there was an option for the second holder to initiate their call. My husband proceeded, and after he finished his call we were done!

Provide Additional Support Documents

Theoretically, once you complete the ID verification, your part is done, and you wait for an email with your account details. Unfortunately, that wasn’t the case for us. Even though we each submitted pay stubs with the company information, we were asked by the representative to email further documentation to prove our professions and then call back. In the end, we both submitted our offer letters from our current employers showing our titles and pay rates. This seemed to suffice. We were also asked to submit the signed page of our most recent tax return and each had to submit a W-9.

Once we had provided the additional documentation, we called back (through the app) and were met with some technical difficulties through no fault of our own. Apparently, some U.S. cell phone companies were blocking the text with the verification code. Atlantico said they were fixing the problem and to call back every couple of days to retry. After about two weeks, we were finally able to complete both of our ID calls and the account opening process. Yay! We’re good to go right? Not exactly.

Receive Account Details & IBAN

Whereas you can walk into a U.S. bank and walk out with an open, functioning account, it comes as no surprise that things don’t work quite that quickly in Portugal. Even on the ground in Portugal, it takes 2-3 days to have the account opened. We were informed by the representative on our call that account details should arrive in our inbox in about 7-10 days, but according to some members of Facebook groups, it was taking 4-5 weeks!

An International Bank Account Number (IBAN) will be issued and this is your account’s unique number and what you use to fund your account.

Fund Account

(Updated initial transfer amount June 2022)

Your initial transfer must be at least 1000€ to officially fund and open the account. You cannot use international money transfer services like TransferWise for this first deposit, and this initial transfer must come from a bank account in your name. It can be expensive to send money from bank to bank as the conversion rate is usually terrible and the fees can be high. Therefore, I suggest you only transfer the initial 1000€ this way and then use an online service that offers low fees and favorable conversion rates. TransferWise is by far the most popular.

Transfer Funds Needed for Application

(UPDATED w/ 2024 Financial Requirements)

Once your account is funded and ready to use, you’ll need to transfer the amount needed to prove sufficient funds for your application. Currently, the requirement is for one year’s worth of funds equal to the minimum wage in Portugal. The minimum wage for Portuguese workers includes 14 payments per year. Confusing, but it ultimately means they receive 2 bonus payments per year.

1st Adult:

100% of the current minimum wage (820€ x 14 months) = 11.480€

2nd or More Adults:

50% of the current minimum wage (410€ x 14 months) = 5.740€

Children:

30% of the current minimum wage (246€ x 14 months) = 3.444€

So for a family of four (two adults, two children), the total amount you’ll need in your account is 24.108€. One thing to note is that SEF offices have recently extended the initial temporary residence permit from one to two years, but they haven’t officially increased the amount of funds needed from one year’s worth to two. Our lawyer said it is not necessary to fund the account with two years’ worth of funds, BUT that more money does look better if you can swing it.

As you can see, even though this is the “easier” way of opening a bank account in Portugal from abroad, it is by no means easy. I did ask our lawyer about helping us, but to be honest, the process sounded so complicated it made the above steps look like a cakewalk. To be honest, had we not had the technical hiccups, the process would have moved much faster. In addition, if more banks start allowing online account opening, ATLANTICO won’t be bogged down with so many requests. Here’s hoping and good luck!

***UPDATE***

After waiting and waiting and waiting, we consulted our lawyer about alternate banking options. She mentioned a few backup options and we had one backup option in our back pocket as well. In the meantime, our lawyer's business partner/our tax representative called the bank to check on the progress of opening our account and to hopefully move things along. This was on a Friday, and the next Monday morning our account details were in our inbox when we woke up. Coincidence? Probably not. So, I’d suggest if you’re working with an immigration or tax representative and having any trouble getting your account open, a quick call from them could do the trick. 😉

Exactly four weeks and three days after completing our ID video conference, we FINALLY received our account details. This included an account number, IBAN number, client number, and SWIFT number. We promptly wired 250€ from our Chase Bank account, and once that hits the ATLANTICO account it will officially be open. Then, we can transfer the larger amount as proof of funds for our VFS interview/visa application. Here’s to another check off the list!

Check out these resources for more to-do list items you may need to think about when moving abroad.

Renovating Life contains affiliate links. If you make a purchase through these links, we will earn a commission at no extra cost to you. As an Amazon Associate, we earn from qualifying purchases. Links like this allow us to continue providing top-quality content at no cost to you.